We are pleased to announce that we have led an investment in Wapi Pay, a fintech startup founded by Paul Ndichu and Eddie Ndichu, that is powering a new Africa-Asia payment gateway to help bridge the exchange of economic value between the two continents.

Wapi Pay, based in Kenya and Singapore, operates across Africa and is enabling corporates, merchants, and individuals to easily send payments and remittances between Africa and Asia.

With an initial focus on the China-Africa corridor, Wapi Pay has also added coverage for other major Asia economies that are trading with the continent, including India, Indonesia, Japan, Thailand, Philippines, Malaysia, and Taiwan.

Africa's relationship with Asia, and in particular China, has deepened greatly over the past few years and has created an ecosystem of symbiotic flows between the two regions.

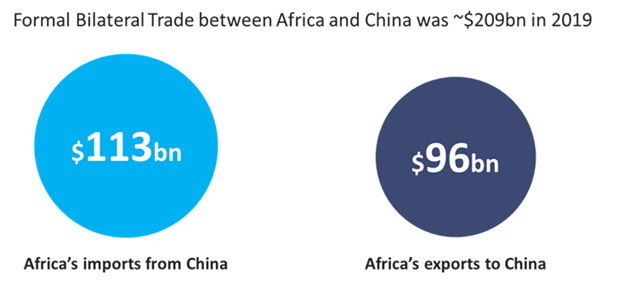

On one hand, payment flows from Africa to China are driven by African merchants and large corporates purchasing goods and services from China. This is an enormous stream of payments, estimated at $113 billion in 2019, supporting trade in items as diverse as clothing, consumer electronics, food, and telecom equipment.

Additionally, large Chinese corporates operating in Africa remit a portion of earnings back to their home country. Within Africa, it is estimated that more than 50% of infrastructure, mining, and energy projects are performed in partnership with Chinese corporates operating in Africa.

The inverse side of the relationship is the products that Africa provides to China resulting in payment flow from China to Africa for commodities, oil, and ore, as examples.[1]

This inverse flow amounted to $96bn of exports from Africa to China in 2019; resulting in total bilateral trade between Africa and China of $209bn that year.[2]

And yet the traditional payment channels between Africa and China are wrought with pain-points of slowness, high rates of transaction failure, and expensive transaction costs. A payment from Africa to China can take up to a week to process and costs up to 15% of the payment value due to fees and foreign exchange conversion to intermediaries along the traditional network path.

Wapi Pay’s founders started the company to help solve this, and enable a seamless, frictionless way to send money, for payments and remittances, between Africa and Asia, at a cheaper cost.

As a new payment gateway between the two continents, Wapi Pay brings an incredible value proposition to an enormous and untapped market opportunity.

Paul and Eddie are impressive founders with deep experience in African fintech and banking. We are very excited by their vision to evolve Wapi Pay, building up from payment rails, into a broader ecosystem of fintech services to merchants and corporates across Africa and Asia.

As part of this pre-seed round which we helped syndicate, EchoVC was joined by MSA Capital, a leading venture and growth capital investment firm based in China, and by Kepple Africa Ventures, an Africa-focused early-stage VC firm based in Japan. We look forward to working closely with Paul, Eddie and our co-investors on this next phase of growth.