Two years ago this November, in partnership with Shell Foundation and UKaid, we publicly launched the EchoVC Eco Pilot Fund I with a straightforward thesis: take institutional first check risk and back elite African founders at the earliest stages building Africa-focused climate and climate-adjacent solutions that lift incomes while cutting emissions, in service of smallholder farmers, transporters, and micro-entrepreneurs (ME).

We explicitly designed this pilot fund as an experiment to quickly but prudently unravel the knots in backing underrepresented founders in historically underfunded sectors. What we learned has reshaped how we think about early-stage climate investments in Africa.

Our Eco Pilot Fund I had two core objectives:

Write first institutional checks into elite African founder-led companies.

Debug how to employ early-stage flexible financing and support structures to finance underrepresented founders and underfunded sectors.

We also explored:

Energy storage.

Cooling innovations.

Off-grid clean [electric/pressure] cooking applications and solutions.

Smart energy systems/mini-grids.

Renewables access and new applications.

Waste.

New approaches to urban mobility, including alt-powered two- and three-wheelers.

Rethinking business models.

By deploying $2.75 million of pilot investments across 15* companies, we’ve confirmed that the climate tech opportunity in Africa is simultaneously larger and more nuanced than anyone imagined. Our blog post, "The Missing Middle: Why Africa’s Climate Operators Are Stuck Between Studios and Scale," serves as the lead-in to this one.

Eco Pilot Fund I represents more than just another climate-focused investment vehicle; it’s a thoughtfully designed, experience-formed strategic response to the unique challenges facing African climate entrepreneurs and a blueprint for how sophisticated investors can drive both returns and impact in underserved markets. The fund was designed to support thoughtful ‘experiments,’ each of which had a very low financial cost of failure but potentially uncapped upside.

This post distills observations, learnings, and recommendations from our journey, spanning neoenergy and energy access, food systems, waste, sustainable transportation, circular economy solutions, and the micro-SME backbone of African economies.

The Market Reality: A House of Mirrors

While headlines celebrate climate tech becoming Africa’s fastest-growing investment sector, capturing one-third of all startup funding by 2024, the reality beneath those numbers tells a more complex story. Yes, capital is flowing, but it’s concentrating in familiar patterns: late-stage deals (many still with early-stage risk profiles), technologies with questionable local proof points, and founder profiles that mirror traditional calcified venture capital preferences.

Courtesy of ‘A Playbook for Financing ClimateTech in Africa.’

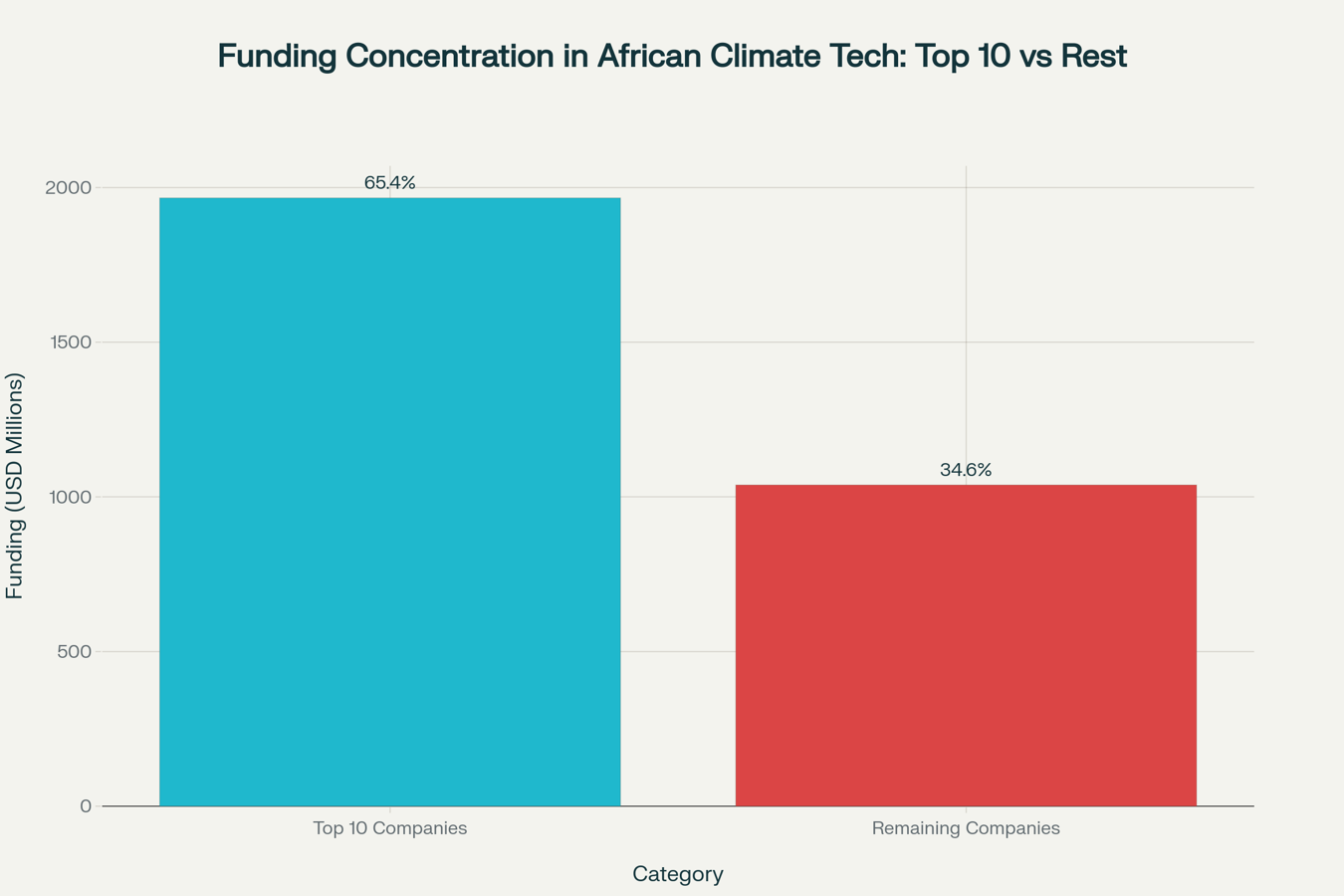

This growth masks a troubling concentration problem. Just 10 companies captured more than 50% of total climate investments between 2015 and 2024. d.Light, SunKing and BBoxx/PEG raised not less than ~$1.3 billion in aggregate. Only ~147 climate tech ventures have raised any disclosed institutional funding.

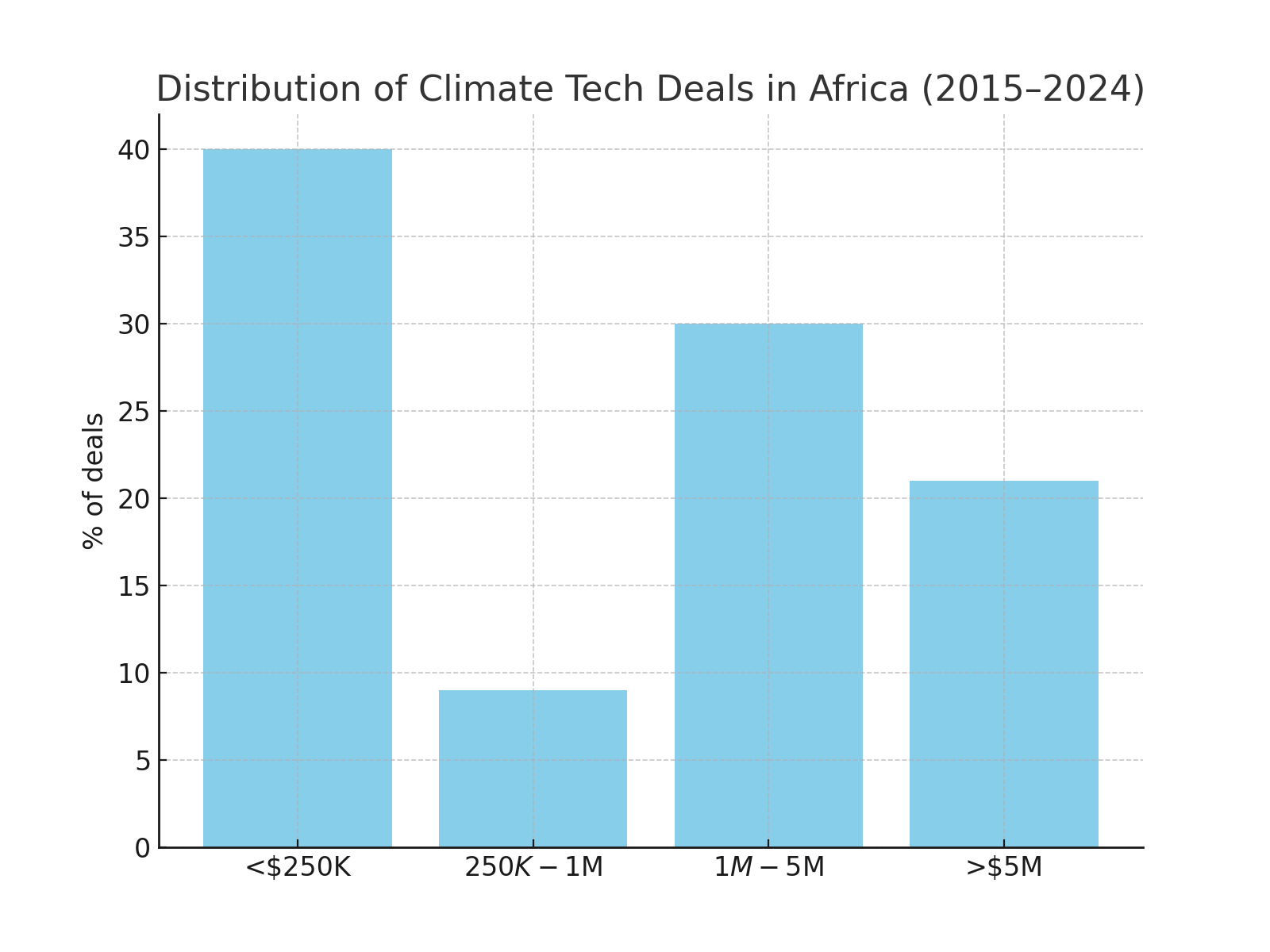

Most tellingly, per the playbook, fewer than 10% of deals in the last decade fall in the $250K-$1M range, precisely the capital band where early pilots must become investable businesses and where risk-on funding is essential to make that leap.

The result? Potentially transformative innovations requiring thoughtful, market-tethered experimentation and companies led by women (or founders of African descent) remain systematically underfunded.

““There’s a tremendous amount of craftsmanship between a great idea and a great product… and it’s that process [of experimentation] that is the magic. It’s through the team—through a group of incredibly talented people—bumping up against each other, having arguments, having fights sometimes, making some noise, and working together... they polish each other and polish the ideas. And what comes out are these really beautiful stones.””

What The Data Says (And Why The ‘Missing [Extended] Middle’ Persists):

Headline funding momentum conceals significant concentration risk and structural gaps. Four patterns seem to shape how founders and funders actually execute in real life:

Concentration: A small set of narrative-driven product categories and companies capture most capital, while frontier, local founder and science-led deals lag.

Stage mismatch: Sub-$1M checks are scarce; the $250K–$1M band, the bridge from pilots to commercialization, remains dangerously narrow.

Instrument mismatch: Equity gets overused where outcome- or asset-backed or revenue-linked instruments would fit better; debt remains expensive or unavailable early on.

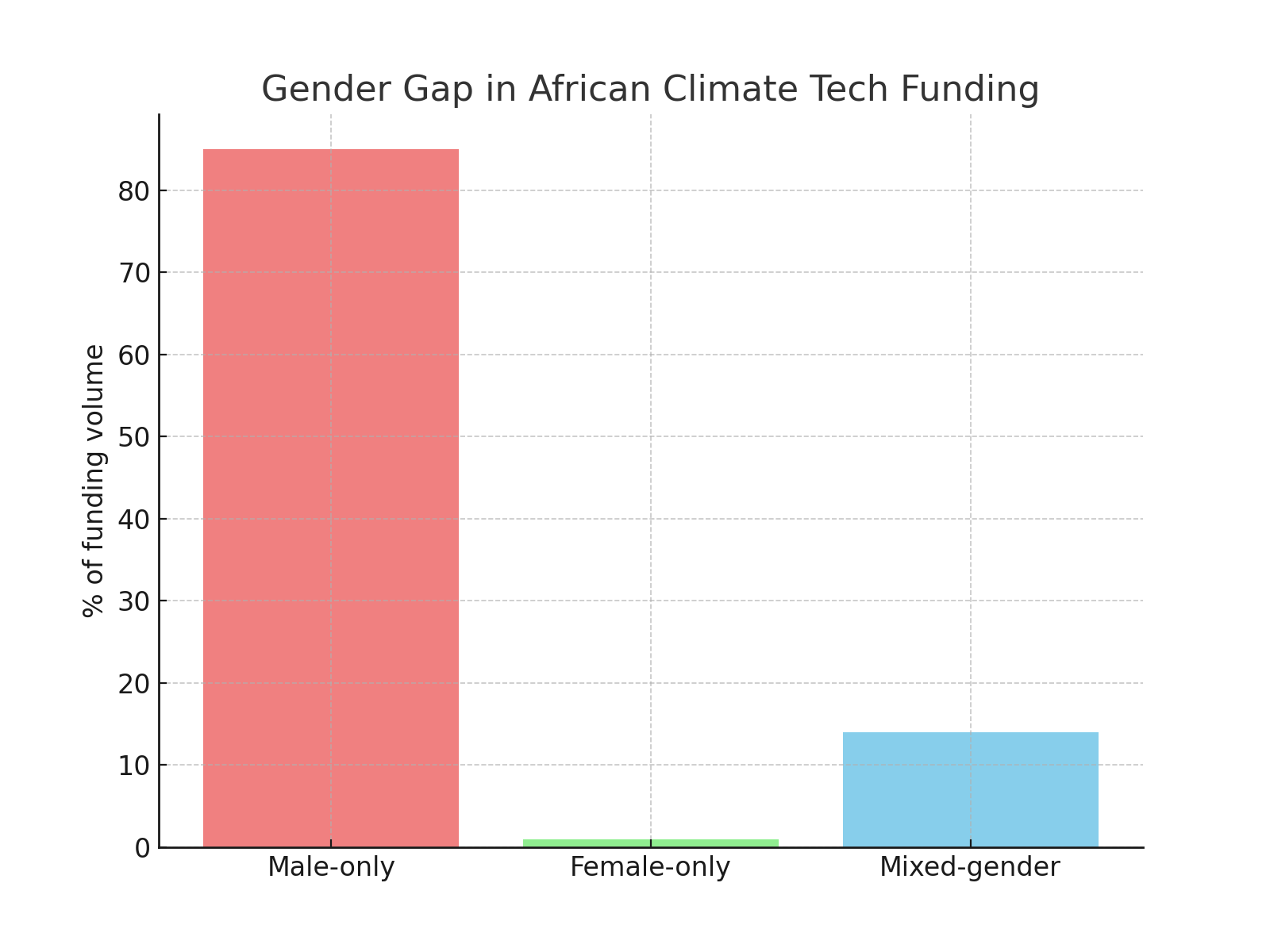

Geographic and gender skew: Big-4 markets and male-led teams dominate; women-led and locally rooted [science] teams face longer paths to everything.

Courtesy of ‘A Playbook for Financing ClimateTech in Africa.’

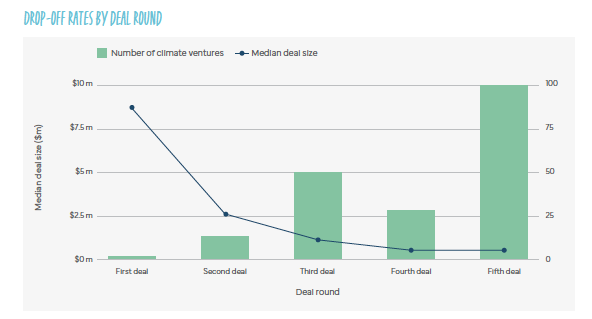

The data also reveals a concerning fade rate: only about one-third of ventures that secure initial funding progress to a second round.

Courtesy of ‘A Playbook for Financing ClimateTech in Africa.’

This “missing [extended] middle” problem appears to hit hardest for:

Science-based ventures requiring longer development and go-to-market cycles.

Women-led and local founder ventures [that appear to be] facing systemic barriers.

Hardware solutions needing working capital for inventory and invoicing delays.

The Four Gaps We Encountered:

Through our thesis-building and investment process, we identified four interconnected gaps that traditional VC approaches appear to consistently struggle to address:

The Pipeline Gap: Founders (many first-timers or sole founders) navigate lengthy R&D cycles, murky product-market fit, and tangled policy hurdles. Women-led or locally rooted teams and science-based ventures face the steepest challenges, often missing patient capital or the [cross-border] technical+commercial blend that draws institutional capital.

The Funding Gap: Early checks arrive as being too small, too rigid, or too late. Perceived risk scares off local investors, while international capital chases later-stage, proven models. This creates a classic "valley of death" between proof-of-concept and commercialization. We are still puzzled by stories of investors that spend 9-12 months doing diligence and then invest $50,000-100,000, if at all.

The Gender Gap: Male-only teams capture 85% of funding volume, while women-only teams secure less than 1%. Yet data reveals that mixed-gender teams with scientific and business expertise will outperform single-gender, single-discipline alternatives in impact persistence, community reach and adoption and positive financial returns. Examples include Koolboks, M-KOPA, SunCulture, EcoPost, FiberText Green Paper, and Solar Sister.

The Market Paradox Gap: Africa’s climate tech sector shows a unique trait that distinguishes it from other emerging markets: market-sensitive service innovation has outpaced infrastructure development. Mobile payment systems, ride-hailing platforms, cheaper-to-operate e-two-wheelers, and non-traditional asset financing models emerged before broadly held bank accounts and credit card schemes, adequate transport networks, distributed charging infrastructure, or deep and accessible lending pools existed. Much of this entrepreneurial innovation has empowered microentrepreneurs, crucial job creators in a landscape where private and public sector employment opportunities grow increasingly scarce.

Investors often hesitate, and often rightly so, to underwrite promising companies when they think invested funds will go toward market creation (as first to market infrequently results in first to crack it), but many promising markets are simply iceberg-like: mostly unseen, misunderstood, unmapped, and unserved, but ready for solution-focused operators. Business model innovation, e.g. the sachetization of consumption (bite-sized PAYG is now well understood) and distribution (not as well understood), is difficult to grok for those that are used to traditional product development, market pricing and adoption models as seen in more developed markets, but it can be the path to unearthing materially sized market opportunities.

Simply put, product-led growth (PLG) can be at par with, and may often trail, model-led growth (MLG).

An unspoken realization about the lack of [public goods] infrastructure (or the unfair imposition of its provision on the private sector) is that, by definition, it limits the size and quality of the companies that can be built.

This interconnectedness creates both opportunities and challenges.

Our ‘Ground Radar’ Observations:

Rarity of Elite Founders

The founder archetype we back, ambitious, grit-filled, high-integrity operators with deep customer insight, pastor-like magnetism, and sharp execution, is rare but decisive. Our hit rate jumps when we find teams with a hacker mentality, founder–market fit, and functional balance (science + commercial or commercial + domain expertise/networks).

Female Founder Gap

Our Eco Pilot I portfolio is approximately 50% female (co)founded. We’re aiming higher, but the top-of-funnel remains narrow. Disappointingly, we were seeing one in twenty in the pipeline for a while, even with open requests for startups and an open door approach to pitches. The ecosystem needs deliberate sourcing, coaching, and catalytic capital for women-led teams, especially in science-heavy verticals.

Capital Intensity & the Equity Trap

In energy, mobility, cold-chain, and agri-infra, working capital, assets, and loan books drive early needs. Funding these with equity alone proves inefficient and dilutive. Blended financing stacks will outperform and expand the potential for financial upside.

Ticket-Size Constraints

Pre-seed checks of $50k–$300k help companies start, but many opportunities need additional infusions of $300k–$500k at Seed and $750k–$1m at Seed+ to reach the consensus milestones that unlock institutional follow-on capital.

From our vantage points, we feel increasingly confident that smaller debt and equity vehicles are better equipped to underwrite very early-stage investments in this sector because of the mismatch of typical VC fund structures, but fund economics will require a rethink, possibly innovating around reasonable manager fees and fewer foot dragging processes while keeping vehicles nimble. Our sense is a not insubstantial number of fund vehicles are [sub optimally] designed for LP fit rather than market fit and the consequential fund size inflation has deleterious effects on properly weighted company pipelines and outcomes.

Investor Fatigue in Crowded Themes

Agri-tech, logistics, PAYG solar, and e-mobility have seen excitement-fueled ‘overexposure’ without consistent positive financial returns. Operators seeking investment must articulate ‘why us, why now?’ while demonstrating capital efficiency paired with significant momentum and market traction.

Furthermore, we believe that optimal investment structures and target return profiles of sustainability focused investments make for an awkward fit within generalist (Africa-focused) VC funds making opportunistic investments. Many climatech opportunities tend to be of the slow burn variety, and can take time to hit escape velocity, particularly when compared to say, fintech companies (even with the latter’s net 1-2% margin backdrop).

Sustainability focused investments should be made from standalone sector-focused vehicles with patient runways and investors. Such investments should properly be made from a vehicle for which sustainability is core to its thesis.

Seed-Stage Scarcity

At seed, only a few companies have been able to demonstrate directionally positive scalable unit economics without heavy subsidies. Late-seed/early Series A players exist (that are still willing to underwrite market risk), but we will remain selective and data-influenced at the seed stage. This means a) quantitative and qualitative evaluations of multi-disciplinary and mixed gender teams and product- and market-fit, b) market mapping, traction and adoption, c) unit economics, d) scalability indicators (and not necessarily proof points), forecasted real-world outcomes and impact and, e) patent and latent risk analysis. Priming the pre-seed pipeline is thus extremely important.

The Paradox of Optionality

Designing and deploying climatetech solutions often requires persistent local presence. Elite local founders can often maintain optionality (career and relocation) but the end customers that we all serve appear to have none. We have been quite distressed by how increasingly tough life is for the mass market population in Africa and recognize that increasing investing urgency paired with eliminating (or mitigating) founder and funding friction can accelerate the pace and quantum of impact.

Elite founders that know secrets about nonconsensus market opportunities and can design and deliver zero-cognitive-load products and solutions should always be supported and funded.

What Companies Actually Need:

Access to ‘SKU capital’: Assets, inventory, lease/loan books, and working capital in local currency.

Creative finance: Recoverable grants, revenue-based finance (RBF), asset-backed facilities, guarantees, and green bonds. Regarding initiatives, there’s good work being done here but products in market are still quite limited.

Data & research: Streamlined diligence, sector benchmarks, and shared market intel to accelerate decisions.

Capacity: Governance, financial ops, climate MRV, and shortened enterprise sales cycles, delivered as targeted technical assistance.

Ecosystem: Mixed-sized local funds and credit sidecars; accelerators and incubators that understand financing instruments; corporate partnerships and policy navigation.

What We Learned: Five Key Insights

“Perfect” Companies Don’t Exist – It Takes Effort To Build Them

The venture community suffers from “sector fatigue” in areas like agtech, logistics, PAYG solar, and e-mobility. Too many companies have been hyped with disappointing performance, creating impossibly high bars for new entrants. Early-stage founders now need to appear “perfect” to attract significant funding, a paradox that contradicts the well-known principle of ‘Don’t Let Perfect Be The Enemy Of Good.’

Instead of waiting for perfect companies, we invested early and leaned heavily into operational support. We discovered that the right mix of capital and hands-on expertise at the pre-seed stage bridges critical gaps in team composition, product development, and go-to-market strategy.Capital Structure Matters More Than Amount

Traditional equity financing often mismatches the needs of climate hardware or hybrid companies. These businesses require patient capital for long development cycles, asset financing for physical deployment, and working capital for inventory management. Business model innovation should also be lauded. For example, hardware-as-a-service can scale sustainably (as M-Kopa has ably demonstrated).

Our approach has focused on being strategic about risk, dependencies, financing instruments, sequencing, and timing. We started with first-check risk, helped secure grants, and created innovative hedging structures to attract lower-cost local currency revenue-based bank financing.Women-Led Companies Need Different Capital Lenses

Our portfolio is 47% women-led or mixed-gender management teams, significantly higher than industry averages. These ventures consistently demonstrate superior capital efficiency and stronger read-ahead adaptation to market challenges. Yet they face systematic barriers accessing traditional venture capital, requiring deliberate and different risk-on funding approaches.Policy Environment Shapes Investment Opportunity

Enabling policy proves as important as funding in determining venture success. Rwanda’s mandate for electric motorcycles, Kenya’s solar tax exemptions, 88% renewable power-sourced generation and upcoming E-Mobility Policy roll-out, Ethiopia’s ban on ICE (internal combustion engine) vehicle imports, and Nigeria’s EV and solar panel production partnerships created immediate market opportunities that transcended traditional investment risk analysis. Regulatory support matters as much as technical capability.Local Context Drives Different Solutions

The most successful companies we’ve seen didn’t transplant solutions from other markets. Instead, they mapped and developed innovations specifically adapted to African contexts. This meant understanding everything from mobile payment penetration, to informal transport networks, to pairing bite-size PAYG business models with on-demand access to pricey infrastructure, to seasonal agricultural cycles and climate risk, and why mislabeling smallholder farmers is a mistake.Companies that achieved product-market fit fastest had founders with deep local knowledge combined with international technical training/exposure. They understood both the problem context and accessible global solution frameworks.

By way of illustration, neoenergy® is a gigantic opportunity. It is estimated that Africa has ~40% of global solar power potential yet accounts for ~1% of installed solar power capacity with nearly 600 million Africans still without electricity. As the World Bank put it starkly, 85% of the world’s population without electricity lives in sub-Saharan Africa. The implication of this is crystal clear. Waiting for public good infrastructure to be built, installed and delivered is unrealistic, leaving the burden and opportunity to brave entrepreneurs, their fellow travelers and support systems.

It’s worth noting that financial innovation is happening at the later stages of companies. For example, D.Light finalized a $176 million securitization facility enabling it to serve six million households in East Africa whereby PAYG monthly receivables are securitized, offering an estimated 12% IRR to investors. This structure distributes risk among investors, sovereign entities and guarantors while aggregating and extending the benefits of group buy purchasing to drive positive economic and social impact. As of July 2025, the company has securitized $842 million of combined purchasing value. SunKing recently closed a $156 million securitization offering (8.5% yield) to serve one million households and has raised $450 million in aggregate securitized financings so far.

Finally, due diligence requires spending significant time understanding the how and why of local market dynamics rather than just comparing to international benchmarks or lazily relying on X for Y constructs. Another interesting exercise we work on with founders is unearthing who (or what [in]visible constituency) actively seeks to ensure that the founders not succeed when the outcome of their successful market-deployed solution is price deflation (so whittling away unearned arbitrage) or creating positive optionality for the edge consumer, SHF or MSME. A historical example is neoenergy and diesel suppliers in Nigeria (IYKYK). Understanding this dynamic can help influence the design of GTM strategies and (thoughtfully engineered) defensive partnership networks and pricing.

What Has Worked For Us (So Far)

Multi-SKU financing beats single-instrument investing: pair equity for software and team opex with debt-like capital for assets and working capital, plus grants for derisking market segments.

Coordinated BD intros accelerate time-to-revenue more than larger equity checks alone.

Using grants to close market risk gaps that could stall otherwise fundable companies.

Our Approach: Elite Founders, Invisible Markets, Eco-Dynamism

Identifying the Sweet Spot

Our thesis centers on a critical insight: Africa’s [climate tech] landscape is dominated by “invisible markets,” sectors with enormous potential that traditional VCs overlook due to perceived complexity or capital intensity. Recognizing this requires a sophisticated understanding of Africa’s interconnected challenges.

The Elite Founder Thesis

What we believe our portfolio highlights is an emphasis on founder quality over sector trends. Our go-forward investment criteria (which frames our founder archetype) prioritize:

Founder background, intellectual curiosity and genuine passion for the climate space.

Execution capability across customer acquisition, technology, and operations.

Talent acquisition and team-building skills.

Adaptability and flexibility, iterative vision, observation-based tuning skills, persistent focus on the problem stack, and reflexivity.

Investment readiness, coachability and storytelling skills.

Integrity.

Ambition with global perspective, broad-based impact, and grit.

Inclusive approach to team diversity, ultra sensitivity to customer needs, and deep empathy.

Our standing order is to back elite founders focused on serving non-consensus invisible markets while building for scalability.

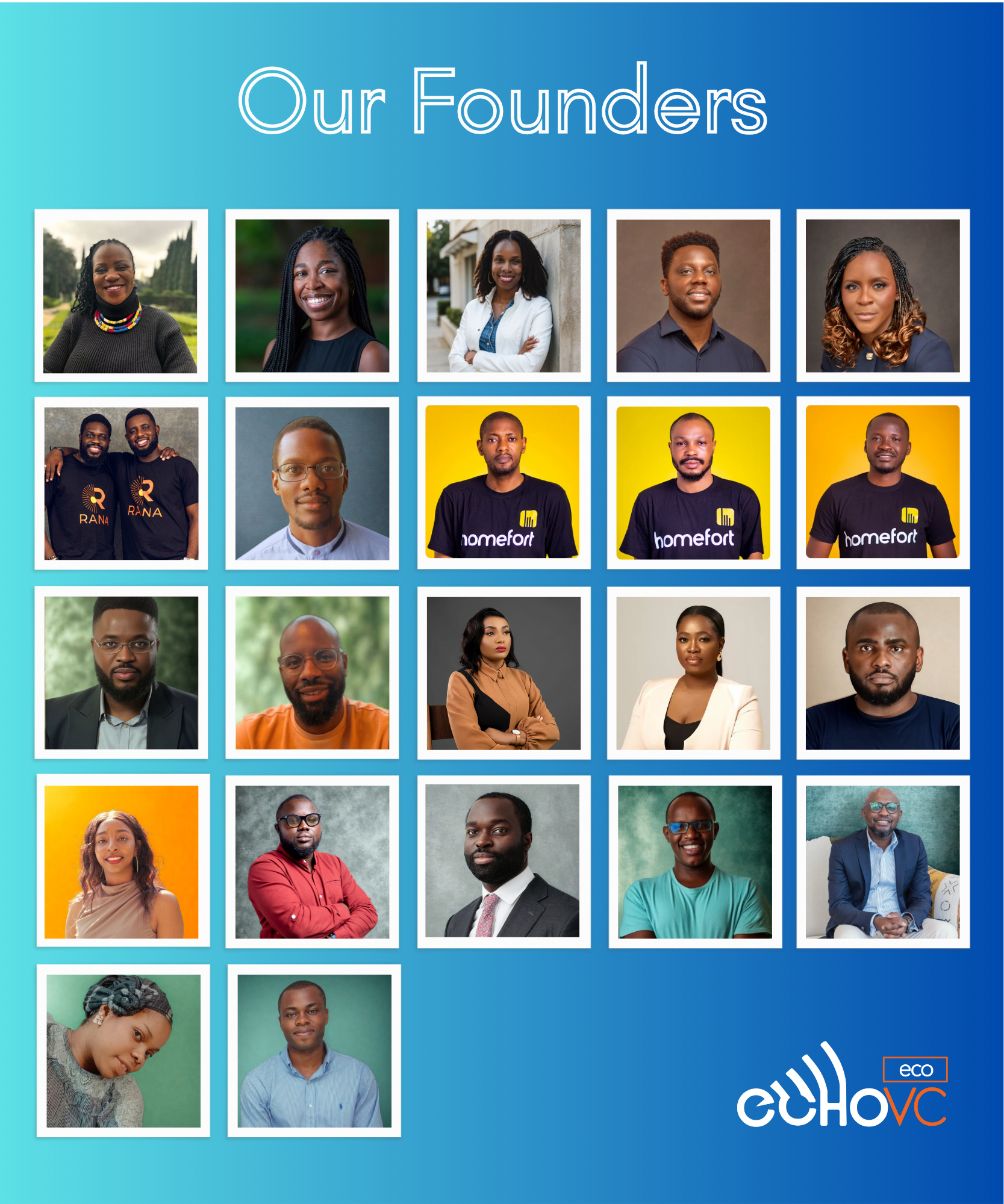

The founders and teams that selected us to back* them in Eco Pilot Fund I are as follows:

* Includes prior grant recipients

Impact Indicators Tracked:

Eco Pilot Fund I’s impact indicators include the following:

Number of MSMEs supported or lifted, and number of customers served

Measured in collective ‘units,’ we forecast 310,000 by ’27 and 880,000 by ’32

Number of MSMEs founded/owned/led by women (and women-as-end-users)

Aggregate amount of capital disbursed to MSMEs (including equity, debt and grants)

New jobs created and revenues generated (direct/indirect economic generating units [EGUs])

Beneficiary span (e.g. MSMEs/SHFs/Low-income households)

Additionality and amount of leverage

GHG emissions reduced or avoided.

Ten-year target outcomes (Platform):

Five million EGUs

Three Million Households (reach and income lift)

Fifty+ EchoVC Eco companies backed

Five Million SHFs and MEs supported

Five Hundred Thousand+ MT CO2e in GHG savings/reductions

The Road Ahead: Scaling What Works

Traditional VC models seek "high scalability and asset-light capital efficient models" that don't align with many climate tech solutions. A key insight in climatetech investing, where many opportunities are asset-heavy, is recognizing the importance of separating technology and operational execution underwriting from physical assets in the financing structure.

Perfect is the enemy of possible. Invisible markets are the frontier. Elite founders are the key.

Our market focused solution is to create a new platform, EchoVC Eco, that offers multiple funding "SKUs" available as risk- and stage-metered API-style calls:

Equity for scalable technology, IP creation, and execution-driven components.

Debt/asset financing for physical assets and infrastructure.

Revenue-based financing for cash-generating assets and inventory.

Catalytic working capital pooling to eliminate process delays.

This approach keeps venture capital focused on fast-paced high-growth potential while ensuring adequate funding for capital-intensive components. We've also observed that traditional debt works best when business model and management team maturity exist. Early-stage companies with high-growth potential but lacking this maturity deserve access to nimble debt-lite financing products.

We have the highest conviction that a cohort of companies, startups and high-growth SMEs alike, will hit escape velocity through a combination of pre-seed/seed financing, grants, and debt-like instruments. In other words, they'll likely never need later-stage VC or PE-lite investors.

Fund Structure Evolution

Based on our Eco Pilot learnings, we plan to launch our EchoVC Eco Platform that will offer multiple specialized vehicles rather than one large generalist fund:

EchoVC Eco Pilot Fund II/III/IV/V ($3M): Direct replication of our successful pilot model, targeting 15 pre-seed investments and re-upping every 24 months.

EchoVC Eco Seed Fund ($30M): Seed-stage funding for new or existing portfolio companies and similar ventures preparing for Series A readiness. Maintaining fund size discipline is critical.

EchoVC EcoCatalytic: Blended finance vehicles offering small footprint debt and working capital, foundation grants, directed government guarantees, and institutional co-investment. TAFs will be invested in growing/developing portco team skillsets and cross-pollinating knowledge.

EchoVC will continue investing in and supporting Africa-focused pre-seed, seed and seed+ Smart Planet startups and high growth MSMEs that focus on:

Agriculture

Sustainable mobility

Climate resiliency, adaptation, and mitigation

Renewable energy access

Regenerative/circular economy

Empowering MSMEs

Fellow Traveler Strategy and Recommendations

We firmly believe eco investments require a more complex style of ecosystem coordination that’s impossible for any single fund or platform to provide. Our recommendations, some adoptive, to the various constituencies in the ecosystem are as follows:

For Venture, SME and PE-lite Investors:

Write bigger, earlier ‘footing’ checks where the launchpad is currently weakest: $300k–$750k at Seed; $750k–$1 million at Seed+; $1-3 million at Series A-1.

Structure for fit: Use asset-backed facilities and RBF for hardware-heavy models; reserve equity for software and team plays. Securitization works.

Blend capital deliberately: Match currency and tenor to use cases; seek guarantees and first-loss protection to crowd in debt providers. Eliminate complexity.

Underwrite founders, not trends: Insist on disciplined unit economics and clear ‘why now’ narratives in crowded themes but support thoughtful experimentation.

Layer capital creatively: Combine and sequence grants, equity, debt, and alternative instruments to match each capital type to specific business needs. Use equity for technology development, debt for asset deployment, and grants for regulatory compliance and market risk testing.

For DFIs, Donors, and Foundations:

Stand up guarantee and insurance layers that unlock local-currency asset finance as early as Seed/Seed+ stages. Current approaches to blended finance products are too process-heavy and unnecessarily complex.

Fund nimble grants for pilots, MRV (Measurement, Reporting and Verification), and regulatory approvals while keeping process cycles under 90 days.

Back women-led and science-led pipelines with targeted facilities and venture-building support. Speed up processes for fund commitments.

Support local manufacturing and assembly through tax and procurement incentives tied to quality and safety standards.

Build back-office infrastructure: Fund shared services (legal, compliance, technical assistance (TAF)) that reduce and spread costs across multiple ventures simultaneously.

For Corporates and Offtakers:

Co-design pilot programs with purchase commitments or structured offtake options built in.

Enable data sharing and interoperable standards to speed up integrations.

Offer vendor financing or receivables programs to critical suppliers in cold-chain, mobility, and distributed energy.

Create anchor demand: Government procurement access, corporate pilot programs, and off-take agreements provide the revenue certainty that unlocks private investment.

For Policymakers and Regulators:

Reduce landed costs on climate-enabling hardware through VAT relief and duty exemptions for batteries, EV [CKD] components, and solar equipment.

Enable lightweight licensing for small-scale energy and storage while standardizing carbon and impact MRV.

Seed national green credit lines through development banks with risk cushions for early-stage ventures.

Champion enabling policy: Create regulatory frameworks, tax incentives, and import policies that make climate solutions commercially viable.

Develop local capital markets: Help domestic pension funds, insurance companies, and banks build climate investment capabilities to reduce dependence on international capital.

Conclusion: Building the Future We Need

The climate tech opportunity in Africa is real, large, and accelerating. But capturing it requires moving beyond traditional venture capital approaches toward more nuanced, locally-adapted investment models that work.

Our Eco Pilot Fund I in partnership with Shell Foundation represents more than an investment vehicle; it’s proving how sophisticated capital can address market failures while generating strong returns. By focusing on elite founders in invisible markets, using flexible financing structures, and setting explicit inclusion goals, we’ve created a template for climate tech investing across Africa.

Backing underrepresented founders in underfunded sectors in Africa isn’t just strategically important, it’s economically smart and materially impactful. Women-led, science-based, and locally rooted solutions can deliver superior climate impact and competitive financial returns when they receive appropriate capital and other company-building support.

The broader African climate tech ecosystem shows tremendous promise and accelerating growth. However, realizing this potential requires investors willing to innovate beyond traditional VC models, entrepreneurs who can navigate complex funding landscapes, and ecosystem enablers who can address structural barriers.

Climate investments in Africa can deliver asymmetric returns because the perception of risk from the sidelines is materially higher than actual risk when capital and thoughtfully designed company building are structured, paired and implemented correctly.

Voluntary carbon markets (VCMs), for example, are poised to become a ‘game-changing financing mechanism’ for African startups in cold chain, clean cooking, e-mobility, and waste management. With projected market values reaching $35 billion by 2030 and Africa positioned to capture anywhere between $6-30 billion annually (while supporting as many as thirty million jobs), these markets offer unprecedented opportunities for scaling climate solutions while generating substantial revenue streams for innovative African companies.

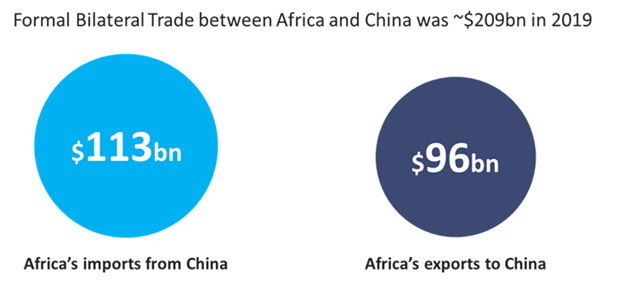

Opportunities for liquidity should organically arise. We anticipate that most exits will be generated by strategic acquisitions like Ignite Power’s acquisition of Engie Energy Access and consolidation plays like SteamaCo and Shyft Power Solutions or BioLite and Baobab+. PE-funded roll-ups always sound easier than they actually are in practice but there will likely be some attempts to do so as those present opportunities to deploy the eight- and nine-figure checks those funds need. Global players in energy (e.g. Shell, BP, TotalEnergies, Trafigura, EDF and Vitol) and financial services (e.g. Sumitomo) will also play a role in making acquisitions that fit existing strategic business units. The open question is if Chinese companies operating in Africa will buy-and-build or build. So far, they appear to lean towards building and executing either solo or in partnership with fellow geo travelers.

The path forward demands expanding both the volume and sophistication of climate investment. We need more capital, yes, but also better tuned capital. The market requires more diverse funding instruments matched to business models, investment timelines aligned with development cycles, and ecosystem support that addresses non-financial barriers alongside financial ones.

As our experience demonstrates, success in African climate tech requires understanding that these ventures aren’t just software or software-lite companies with an environmental angle. Instead, they’re complex enterprises requiring patient capital, operational expertise, and systematic approaches to scaling impact alongside returns. It is also clear that coupling impact with positive financial returns is nonzero sum.

We’re not just building a portfolio of elite founders leading incredible teams to drive long game change. In addition, we’re helping construct the financial infrastructure needed for Africa’s climate transition. The early results prove this approach works. Now it’s time to scale it.

The future belongs to those who can see and serve invisible markets and back the elite founders building solutions for and within them.

Africa is essential, not optional.

Our soon-to-be-launched Eco Platform shows the way forward. The time to act is now!

We invite fellow travelers—LPs, DFIs, foundations, family offices, fund managers and angels—to co-create the financial architecture for Africa’s climate transition with us.

Join us.

About EchoVC

EchoVC is a pioneering early-stage venture capital firm dedicated to empowering underrepresented founders and catalyzing innovation in underserved markets. We deploy sector-focused investment vehicles and leverage Observational VC© alongside deep local insights to strategically back transformative teams, technologies, and scalable solutions across high-impact industries in emerging economies. Our mission drives inclusive GDP growth by supporting ambitious founders building businesses that redefine the future of inclusive global entrepreneurship.

About Shell Foundation

For 25 years, Shell Foundation an independent charity registered in England and Wales, has empowered underserved customers in Africa and Asia to raise their incomes while lowering emission through clean technology solutions. From supporting early-stage innovation to co-designing partnerships with leading organisations and investors to de-risk capital, the Foundation creates the conditions for resilient prosperity among three core groups of people: smallholder farmers, transporters, and micro-entrepreneurs. Find more at https://shellfoundation.org

About Foreign, Commonwealth & Development Office (FCDO)

The Foreign, Commonwealth & Development Office (FCDO) is the United Kingdom’s government department responsible for promoting British interests overseas. It leads the UK’s diplomatic, development, and consular work around the world. Shell Foundation has been proud to partner with the FCDO since 2011. The partnership currently supports two jointly funded programmes under the FCDO’s Research and Evidence Directorate: Transforming Energy Access (TEA) and Catalysing Agriculture by Scaling Energy Ecosystems (CASEE). Both programmes are part of the Ayrton Fund, a UK Government commitment to invest up to £1 billion in Research and Development for clean energy technologies and business models in developing countries.